Cboe Global Markets is due to complete the last of the migrations from its recent acquisitions to a common technology platform in the first quarter of 2025, which chief executive Fredric Tomczyk said will unleash growth.

Tomczyk is approaching the one-year anniversary of his appointment as chief executive. Cboe said in a statement on 19 September 2023 that Tomczyk would become chief executive with immediate effect. He was previously on the board of Cboe Global Markets and a former president and chief executive of financial services group TD Ameritrade.

He succeeded Edward Tilly, who resigned from the company following the conclusion of an investigation led by the board of directors and outside independent counsel that was launched in late August 2023. Cboe said in a statement that the board determined that Tilly did not disclose personal relationships with colleagues, which violated Cboe’s policies and stands in stark contrast to the company’s values.

Senior Cboe executives spoke at the Barclays Global Financial Services Conference in New York City on 9 September. Tomczyk said he feels really good about the company and a number of things have changed from two or three years ago. He argued there is much more expense discipline and margins have been stabilized. At the same time, he said strong organic growth has continued and the balance sheet is in great shape as it kicks off a lot of free cash flow.

In addition, CBOE has stopped making small M&A deals which “weren’t moving the needle” and take up a lot of internal resources. Any future M&A will need a strong strategic and financial rationale, and will probably be more substantive. Cboe will also continue to look at M&A around derivatives market infrastructure, with a focus on options, and also around data and analytics.

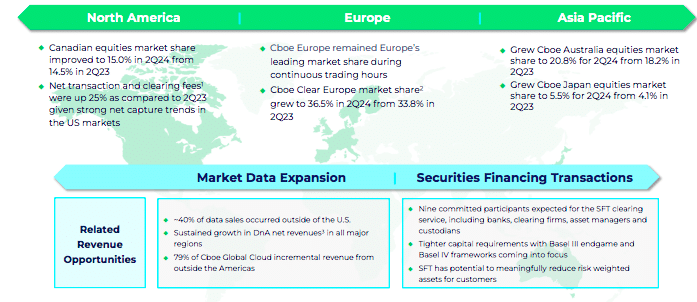

After acquisitions in Australia and Japan, both countries completed their migration to Cboe’s technology platform last year. The remaining technology integration of its acquisition in Canada is planned for early 2025.

Tomczyk said: “After the first quarter of 2025 when the Canada migration is done and all of the technology resources that have been consumed on migrations are done, we can unleash the full power of the organization in terms of growth.”

In Canada, a number of customers have been waiting for the technology to be put onto a common technology platform before engaging in the marketplace according to David Howson, global president of Cboe Global Markets.

Howson said: “Combine that with the listings business in Canada and that makes for an interesting set of differentiated data for customers to think about once it’s on one platform.”

He also highlighted at the conference that the “horsepower” of Cboe’s technology resources are incrementally freeing up as the migrations have been completed. This year, Cboe added a new access layer architecture to its core trading platform that runs all its equities and derivatives markets around the world.

“That innovation opened up a monetization opportunity for that access layer architecture itself, but we could also add new instrumentation, new data and new insights, which institutional customers are asking for,” added Howson.

In terms of growth, Tomczyk argued that Cboe is well positioned for secular trends, especially as overseas investors want access to the US. The management team’s focus will be on using the firm’s technology, internal resources and capital to capitalize on those secular trends.

“There’s now $14 trillion invested in foreign holdings of US securities so there is a big market and big demand,” Tomczyk added. “Governments and regulators are taking away a lot of the restrictions to investing more globally and causing demand back to the US, and the fastest growth area is Asia Pacific.”

In addition, Tomczyk noted that $16 trillion is indexed to the S&P index, where Cboe has a good presence in terms of product.

Cboe’s strategic review has led to thinking about its business model in terms of an import business providing access to the US market, and an export business in taking US products and market structure into overseas markets. For example, Cboe has added single stock options to CEDX, its derivatives exchange in Europe. Interactive Brokers joined CEDX in the second quarter of this year and Howson said volumes have continued to trend upwards, and more market makers and liquidity providers are looking to come onto the European platform.

“One of the advantages that Cboe has is that once we have everybody on one technology stack, that will be unique,” he added. “ I don’t know another exchange that has that ability.”

Howson argued that customers are increasingly global, so the ability to offer their own customers new functionality in a new region with little effort is powerful.

“We have added 500 basis points of market share in Australia and doubled market share in Japan since we have taken possession of the assets,” said Howson. “It is early innings and we have only just re-platformed the technology, so that ramp up begins from here.”

Tomczyk does not expect more geographic expansion. Cboe continues to see if it can find a way to participate in the Indian market and Tomczyk said he would like the firm to be bigger in Japan, with an ambition to be the number two player in that market over time.

Options growth

Howson continued that the options industry is on track for its fifth record year in a row and there is a new phase usage for the complex of volatility products with new users and new use cases coming to market. Major liquidity providers in asset classes are coming into the index options complex, existing users are using a greater diversity of functionality and asset managers are deploying new defined outcome products.

“It is a new phase of usage patterns which has been much more resilient,” Howson added.

Customers have also come back to Cboe Volatility Index (VIX) options, according to Howson. August was the second highest month on record for Vix options as customers hedge risk and monetize those upwards moves in volatility. So far, the third quarter is looking like a number two record for Vix options and the number three quarter for S&P 500 index (SPX) options.

“The options market tells us more volatility is coming in the rest of the year,” he added. “US elections are often a big catalyst for volatility and customers are positioning on both the upside and downside.”

In addition, there has been a greater proportion of institutional engagement. Howson highlighted that on 5 August, when there was a spike in volatility following the actions of the Japanese central bank, institutional customers wanted to manage risk across the curve. Cboe can also now provide two years of data on zero days to expiry products, which quantitative and systematic desks can use to train more algorithms.

Cboe said in a statement in August this year that it plans to launch options on VIX futures on Cboe Futures Exchange on October 14, subject to regulatory review. The firm currently offers securities-based VIX Index options but Howson said the new options will open up volatility trading to a new customer segment who do not trade securities.

In the retail market, Robinhood Markets has said it intends to add index options and futures for active traders. Howson argued that Cboe has products that are in the sweet spot for the active trader base, especially cash-settled index options. Cboe will be investing in incremental sales and marketing aligned with Robinhood and other retail brokers.