Cboe Global Markets is aiming to launch periodic auctions in the US, after success in Europe, as off-exchange trading volume has been increasing.

Adam Inzirillo, head of US equities at Cboe Global Markets, told Markets Media: “In the last couple of years, as off-exchange trading volumes have grown, periodic auctions give the public an on-exchange alternative for executing block trades and attracting natural interest.”

Periodic auctions last for very short periods of time during the trading day and are triggered by market participants, rather than the venue, helping them find liquidity quickly with low market impact, while prioritizing size and price.

Justin Schack, partner and managing director at Rosenblatt Securities, noted the increasing volumes of off-exchange trading:

Greenwich Associates said in a report that the Covid-19 pandemic has triggered a major shift in US equity trading volumes away from exchanges.

The consultancy said off-exchange trading reported to the Trade Reporting Facility remained relatively stable last year between 35% and 40%.

“In all of 2019, there were 16 days with TRF volume above 40%,” added Greenwich. “In contrast, as of early June 2020, the reporting to the TRF had already exceeded 40% of market volume 58 times.”

Cboe launched periodic auctions in Europe in 2015 before the MiFID II regulations went live in 2018. MiFID II introduced double volume caps on equity trading in dark pools. However, trades in periodic auctions on lit venues were exempt from the volume caps.

Inzirillo said Cboe is building on the success of periodic auctions in Europe but the US model will not be exactly the same.

“Some key differences include randomization of the auction message, no broker preference and displayed orders may become part of the auction,” he added.

In the European Union, exchange operators may own dark and lit books, but the current US regulatory regime precludes Cboe from owning and/or operating an ATS. Therefore Cboe intends to introduce periodic auctions on its Cboe BYX Equities Exchange.

Inzirillo said: “Periodic auctions also address some of the issues raised by the SEC regarding illiquid securities, which a high percentage occurs off exchange.”

The introduction of periodic auctions in the US requires approval from the US Securities and Exchange Commission.

Schack said in an email that Cboe’s regulatory filing for periodic auctions cites the SEC’s recent statement encouraging exchanges to propose innovative methods for improving outcomes in thinly traded securities.

“Some may prefer auctions to continuous trading for these less liquid shares, as a way to aggregate latent interest traders are reluctant to display,” Schack added. “Cboe’s European auction, though it has important differences from the US proposal, registers higher market share for smaller-cap issues than blue chips.”

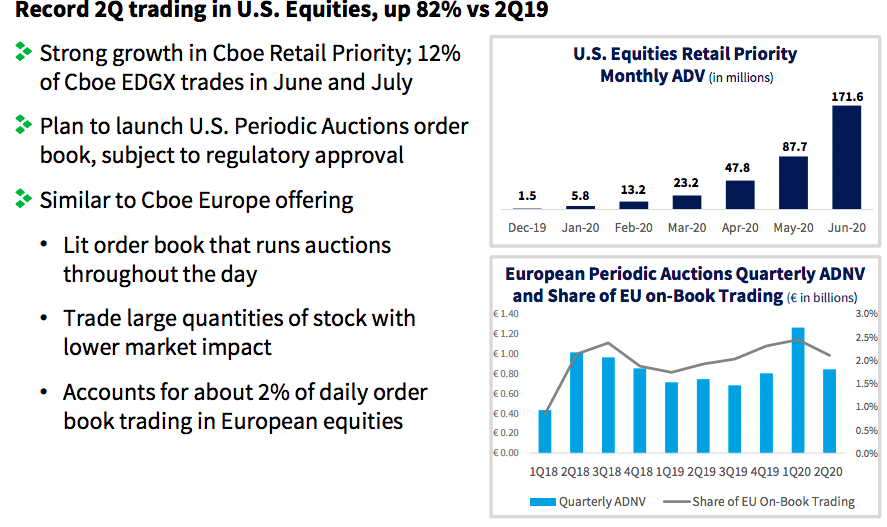

Cboe said its European periodic auction accounted for more than 70% of all periodic auction activity, or approximately 2.4% of notional value traded on European equities exchanges.

“In Europe, our periodic auction volume has been more than an average daily traded notional value of €1bn in the first half of this year, so we see an opportunity,” said Inzirillo.

Schack said the US market is so competitive that it is very difficult for any new venue or innovation on an existing venue to attract a lot of market share. For example, the biggest US dark pool, UBS ATS, is still less than 2% of total volume.

“Another complicating factor is that the recent surge in retail trading has hurt on-exchange market share considerably,” he added. “Considering all that, I’d be surprised to see exchange auctions get to the same level in the US that they’ve reached in Europe — at least not anytime soon.”

However, he noted that the US auction is different from the European version with integration with the rest of the Cboe BYX order book.

“That could help the US auctions — essentially new order types on an existing exchange, with the ability for other order-book interest to participate — build market share more easily than an entirely new venue might have,” said Schack.

Shane Swanson, senior analyst for Greenwich Associates market structure and technology, agreed that off-exchange volume could be rising due to the role of retail trading and their order flow bring directed to market makers such as Citadel Securities, Virtu and Two Sigma.

“With proper systems, risk hedging and management, these firms appear to have been able to internalize more trades with the retail market, resulting in the increase in market share moving away from the exchanges,” said Swanson. “Moreover, as volatility skyrocketed, firms may have decided that dark trading was important to help prevent signaling to a market already in distress.”

Second quarter results

Edward Tilly, chairman, president and chief executive of Cboe Global Markets, said on the results call last week that the strategy over the last four years since the purchase of Bats Global Markets, the European exchange, in 2017 has been vindicated.

“The Bats acquisition enabled us to strengthen our product set with new asset classes for Cboe, including U.S. and European equities and global foreign exchange, and to expand our market for multi-listed options,” added Tilly.

He continued that the exchange has methodically strengthened equities trading through the launch of new trading mechanisms and market enhancements and by cross-selling.

“We saw those efforts pay off in the second quarter when US equities trading at Cboe increased 82% over the previous year for an all-time quarterly average daily volume high of two billion shares traded,” said Tilly.

Volumes were also driven by the Retail Priority program, which was introduced to help improve execution quality and trading outcomes for individual investors and firms that facilitate their orders.

“Retail Priority orders have increased each month since their launch on Cboe EDGX in November 2019, and represented 12% of shares executed on Cboe EDGX in the last two months,” he added.

The exchange reported that Cboe US Equities had market share of 16.1% for the second quarter of this year, compared to 15.7% a year ago.

In contrast market share for Cboe European Equities fell 15.8% from 20.3% over the same timeframe which Cboe said was a result of market profile shifts and short sale bans, which impacted order flow.

Tilly cited the launch of US periodic auctions as another example of the exchange’s focus on equity product innovation. He said: “We believe the US market will also value executing trades in a venue designed to provide minimal market impact.”

On July 1 Cboe closed its acquisition of equities clearinghouse EuroCCP and announced its intention to expand equities derivatives trading in Europe by offering a market model similar to the US .

“We plan to launch that market with trading in equity futures and options based on six Cboe European stock indices in the first half of 2021, with plans to add more benchmarks later,” added Tilly.

In the second quarter Cboe also completed the acquisition of data provider Trade Alert and announced plans to acquire MATCHNow, the Canadian ATS, which completed this week.