Last October Adam Inzirillo was promoted to global head of data and access solutions at Cboe Global Markets as part of the derivatives and securities exchange network’s changes in its senior leadership to support the company’s global growth strategy.

He was previously head of North American equities at Cboe for almost four years, and replaced Catherine Clay, who was appointed to the newly created role of global head of derivatives.

David Howson, global president of Cboe, said in a statement last October: “Under Adam’s leadership, our equities business brought many new client-driven solutions to the market. With Adam’s promotion, I’m excited to see the future innovations that are developed for our DnA business as we seek to meet global client demand for data and access solutions to our markets.”

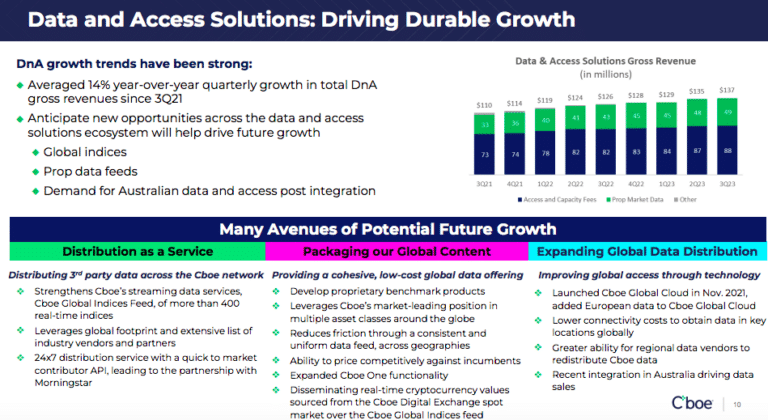

Inzirillo’s new responsibilities include overseeing Cboe’s market data and access services, global indices, risk and market analytics and execution solutions services. He told Markets Media: “It is an important time for Cboe as we spend time and effort on the non-transaction business.”

In market data and access services there will be continued technology initiatives and global expansion.

The Cboe One Feed provides reference quotes and real-time market data for equities. In September 2022 the firm introduced the Cboe One Canada Feed, its first data offering in the country following the company’s acquisitions of MATCHNow, an equities dark pool, in August 2020 and NEO, a fintech organization comprising a fully registered Tier-1 Canadian securities exchange, in June 2022.

Inzirillo added there opportunities to also introduce Cboe One Feed in Europe and Asia Pacific. Last November Cboe Japan completed the transition to Cboe technology following Cboe’s acquisition of Chi-X Japan in 2021, and also introduced Cboe BIDS Japan, a large-in-scale trading solution. The Japanese migration followed the launch of Cboe BIDS Australia, making it the second BIDS Trading offering in the Asia-Pacific region.

After seeing the utility of the Cboe One Feed in the equities market, the Cboe One Options Feed was also launched to address the growth of the U.S options market.

Last November, Cboe also made a regulatory filing to change the Options Price Reporting Authority plan relating to dissemination of exchange proprietary data information.

There is increasing completion in the data business where exchanges have made acquisitions to expand their offerings.

Inzirillo said: “We have transaction data from multiple regions and across multiple asset classes on a global scale, which is a competitive advantage.”

He argued there is an opportunity for Cboe to provide unique datasets leveraging transaction data across regions, which can be made easily accessible via APIs.

Global indices, risk and market analytics

Another of Inzirillo’s responsibilities is global indices, risk and market analytics, where there is also much competition.

In 2023 the firm launched several new indices, including the 1-Day Volatility Index and the Cboe S&P 500 Dispersion Index. The latter was a first-of-its-kind index designed to measure expected dispersion in the S&P 500 Index i..e the impact of company-specific risk on a portfolio by measuring the variability of volatilities for single-name stocks relative to the volatility of the index itself.

Rob Hocking, head of product innovation at Cboe said at the time that the exchange transformed volatility trading with the creation of the VIX Index 30 years ago and the new index provides investors with a further view into market volatility.

“Our differentiator is our derivatives expertise which makes us think differently, such as the dispersion index,” Inzirillo added. “My focus is to make the brand global and we want to cross-sell the total franchise across equities, derivatives, FX and data.”