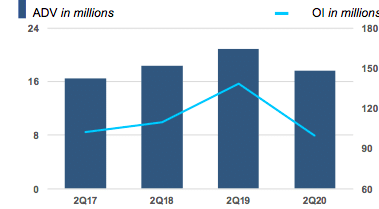

CME Group’s average daily volume in the second quarter of this year was lower than the same period in 2019, although volumes increased outside the US.

The US derivatives exchange said average daily volume in the second quarter of this year was 17.6 million contracts, down from a very strong second-quarter last year. However, average daily volume for the first half of this year grew 13% to 17.6 million contracts from the same period in 2019.

Terry Duffy, chairman and chief executive of CME Group, said on the results call that interest rate volumes had been affected by the Covid-19 pandemic as the Federal Reserve intervened in markets and less volatility in oil prices had lowered volumes in oil contracts.

“However, with global crude oil demand still depressed due to Covid 19, which we believe is a temporary situation, we expect to see market conditions improve as global oil demand returns,” Duffy added.

Sean Tully, global head of financial and over-the-counter products at CME, said on the call that since the high volatility in March, actions by the fed had led to unprecedented low volatility in interest rates. However, at the same time uncertainty over unemployment and the macroeconomic environment has never been higher and the US government is running an unprecedented deficit.

“Once the Fed reduces it’s intervention, the need for hedging and managing risk will become much larger,” Tully added.

International volumes

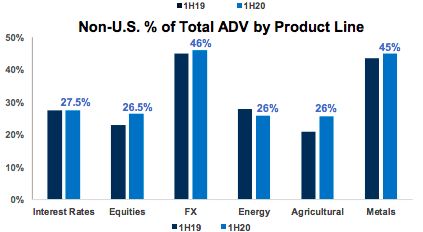

Average daily volume outside the US also grew 21% in the first half of this year to 6.1 million contracts, with year-over-year growth across all six asset classes.

The exchange highlighted that in the second quarter in Europe, Middle East and Africa, equity index ADV grew 75% to one million contracts, the second highest quarterly ADV to date. In the same period in Latin America, ADV in equity index products increased 67% and energy products rose 25%.

John Pietrowicz, chief financial officer of CME, said on the call that four out of the top 10 Asian countries had double digit growth in the the second quarter.

“The Netherlands had a big increase in volume of triple digits, some of which is due to Brexit,” he added.

New products

Pietrowicz continued that CME was continuing to launch new products despite remote working. The exchange reintroduced 3-Year Treasury Note futures earlier this month and options on Micro E-mini Equity futures will begin trading in August.

He added that products launched since 2010 had an ADV of 3.2 million contacts in the first half this year, a 52% year-on-year increase with revenues rising 25% to $193m.

This was driven by Micro E-mini Equity futures which were introduced in May last year.

“Micro E-mini futures continue to be the most successful product launch in CME Group history,” he said. “Over 330 million contracts have traded since launch with a second quarter record ADV of 1.9 million contracts.”

Both the Micro E-mini S&P 500 and Russell 2000 futures had record trading days in June of 1.96 million and 280,000 contracts, respectively.

The new 3-Year U.S. Treasury Note futures had first day volume of of 1,610 contracts, surpassing Ultra 10 first day Globex volume.

“Over 18,000 contracts traded in week and the latest op e interest is over 5,000 contracts,” he added. “Day two volume of over 7,000 contracts exceeded record volume from the contract’s original launch in 2009.”

Julie Winkler, chief commercial officer of CME Group, said on the results call that environmental, social and governance products present a great opportunity, especially due to demand from Europe. Last year CME launched E-mini S&P 500 ESG Index futures.

“We will introduce other ESG benchmarks later this year,” said Winkler.

Market data

Winkler continued that market data had a ‘great’ quarter as revenue was $135m, up 5% from a year ago.

“There was an increase in subscribers with working from home leading to a modest increase in demand for display devices,” she added. “The was also an increase in licensing data for the creation of new products.”

Winkler said the exchange is focused on integrating data from the acquisition of NEX Group, which completed in 2018.

“We are also introducing more flexible distribution of our data as shown by the launch of CME Smart Stream,” she added.

CME said this month that customers can access its delayed and JavaScript Object Notation (JSON) formatted futures data through Google Cloud without the need to provision servers, install network, or manage infrastructure.

Cloud access is expected to benefit CME Group by decreasing cost to access market data; providing data in an environment with cost-effective, on-demand computing resources; and removing the need to provision servers, install network or manage infrastructure.

Trey Berre, global head of data services at CME Group, said in a statement: “We have seen considerable demand for cloud-based data delivery since we launched last year, and we are pleased to offer more solutions that make it even easier for customers to use our data in the format that works best for their individual needs.”

In addition, the exchange remains on track to migrate from the legacy NEX trading systems to CME’s Globex technology.

“We recently announced to our clients the cutover dates for BrokerTec,” added Pietrowicz. “BrokerTec EU clients will begin trading on November 16 and BrokerTec Americas trading will commence on December 7 this year.”

Analyst response

Chris Turner, an analyst at German financial services group Berenberg, said in a report that CME’s results were disappointing as revenues from the recently acquired EBS and BrokerTec platforms both fell year-on-year, while CME’s interest income also fell to $32m from $139m in the same period a year earlier.

He continued that CME’s energy products have a strong bias towards the US shale oil industry, which is likely to be particularly hurt by the fall in global oil prices.

“Although Q2 volumes in these products were fairly resilient, CME has lost market share in open interest (that is, the “stock” of derivatives outstanding), which tends to be a lead indicator for volumes,” Turner added. “We also continue to be concerned that low US interest rates will weigh on demand for CME’s interest rate futures products, which constitute one-fifth of its revenues.”