The financial services industry is facing an evolving landscape of risks and regulatory challenges, with cybersecurity emerging as the most pressing concern.

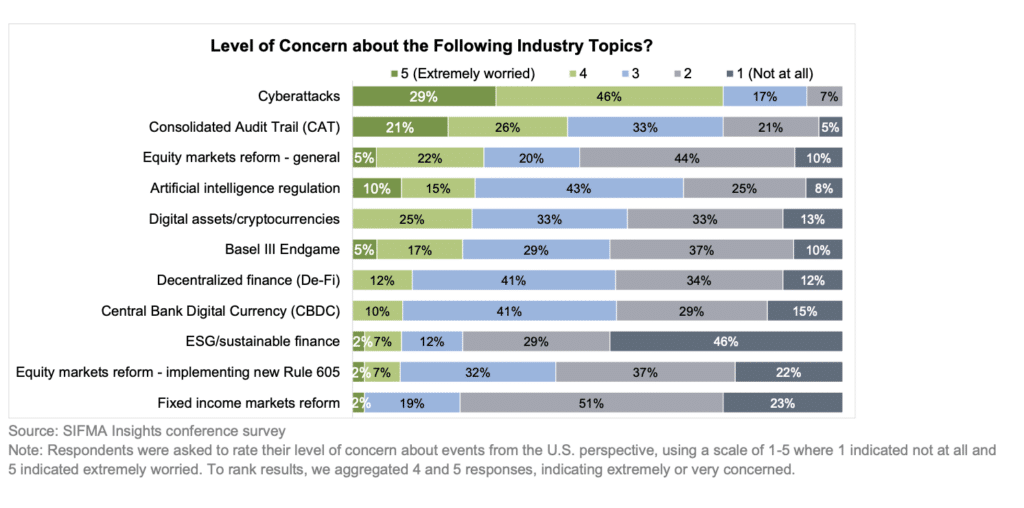

According to the latest SIFMA Insights Equity Market Structure Compendium, 75.6% of respondents indicated they were “very or extremely worried about cyberattacks”.

This underscores the persistent and growing threat of cyber intrusions on financial markets, which could disrupt trading, compromise sensitive data, and undermine investor confidence.

“Cyberattacks pose a very serious risk to financial stability with markets becoming increasingly digital,” John Yensen, President at Revotech Networks, told Traders Magazine.

Many firms are significantly strengthening their cybersecurity through zero-trust architectures, AI driven threat protection, as well as regular penetration and stronger encryption, he said.

According to Yensen, it is becoming more populate to collaborate with government agencies and cyber firms to help share intelligence with the goal if mitigating risks.

“I personally believe that more oversight is needed, especially with third party service providers that play a key role in market infrastructure even though regulations provide a “foundation”. Cyber threats evolve faster than regulations, requiring an adaptive, risk-based approach,” he stressed.

Yensen further said that advancements in AI and automated trading systems introduce new risks.

“While AI enhances fraud detection, it also expands attack surfaces. Threat actors can exploit algorithmic vulnerabilities or use AI-driven attacks to manipulate markets,” he said.

“Firms must implement real-time AI auditing, identity verification, and stronger threat modeling to mitigate risks,” he added.

Following cybersecurity, the Consolidated Audit Trail (CAT) was another major concern, with 46.2% of respondents expressing a high level of worry.

CAT, a regulatory initiative designed to enhance market surveillance by collecting trade and order data from across U.S. equity and options markets, has been a point of contention.

While intended to improve transparency and help regulators detect market abuse, some market participants worry about the security risks of maintaining such a vast data repository, as well as the operational and compliance burdens it imposes.

Beyond cybersecurity and CAT, a notable portion of respondents (26.8%) expressed significant concern over ongoing equity market reforms.

These regulatory changes aim to enhance market fairness, efficiency, and transparency, but they also introduce uncertainty for firms that must adapt to new rules.

Potential changes to order execution, market data access, and competition among trading venues remain key areas of debate.

The financial industry must navigate a delicate balance between regulatory compliance, market innovation, and security.

While cybersecurity remains the top priority, concerns over regulatory initiatives like CAT and broader equity market reforms highlight the industry’s broader challenges.

As firms continue to invest in technology and compliance measures, policymakers and market participants must collaborate to ensure that new regulations do not introduce unintended risks.

In an era of rapid technological advancement and evolving regulatory frameworks, financial institutions must remain agile, proactive, and resilient to safeguard the integrity of the markets.