The digital asset market is shifting from spot trading and physical ownership to the adoption of traditional financial products such as digital asset securities, futures, options and exchange-traded funds and products.

Consultancy Coalition Greenwich said in a report, Digital Asset Market Structure: Institutions Take the Reins, that nearly two thirds, 61%, of buy-side institutions favor exchange-traded funds/products compared to versus 27% who prefer direct physical ownership of digital assets.

“The initial launch of the ProShares Bitcoin Strategy ETF acts as an early example of this long-term demand,” said the report.

The US Securities and Exchange Commission has not approved spot bitcoin ETFs, but has approved ETFs on bitcoin futures.

Other jurisdictions have approved exchange-traded products for spot bitcoin ETFs, including Canada where Fidelity launched a bitcoin ETF in December.

Crypto ETPs are also listed on a number of European exchanges. For example, European issuer ETC Group reached $2bn in assets under management in November 2021.

Bradley Duke, chief executive of ETC Group, said in a statement at the time: “The pace with which we’ve hit $2bn AUM, with our leading Bitcoin ETP now over $1.6bn AUM, indicates continuing increased awareness amongst investors of Crypto ETPs, as well as a clear preference for high quality, physically backed and regulated securities that faithfully track the underlying crypto.”

The Greenwich study continued that over the next two years, the front office will also favor ETPs and ETFs over physical assets or tokenized securities as they have the benefits of clearer regulation, existing approved legal entities to conduct trading operations, a well worn on-boarding experience and standard risk disclosures. The interest is also being driven by the difficulty of traditional institutions in owning spot crypto due its nature as a bearer instrument and the capital requirements for bank holding companies to hold spot on their balance sheets.

Derivatives

In derivatives, there is also a general preference for cash-settled versus physically settled futures according to Greenwich.

“CME has the lead in the U.S. market for crypto futures at the moment,” said the report. “However, the acquisition of ErisX by Cboe is set to create a new behemoth to challenge CME, not to mention the role FTX.US will play.”

CME Group reported record average daily volume in Bitcoin contracts of 10,105 in 2021, an increase of 13% year-on-year.

Last October FTX US completed its its acquisition of LedgerX, which has been rebranded as FTX US Derivatives. The purchase allowed the US-regulated cryptocurrency exchange to gain a designated contract market, a swap execution facility and a derivatives clearing organization which are all regulated by the US Commodity Futures Trading Commission.

Brett Harrison, president of FTX US, told Markets Media that when the deal completed the firm had an increase in sign-ups from institutions such as high-frequency trading firms and market makers who want to be able to trade regulated crypto derivatives in the US.

In the same month Cboe Global Markets said it had agreed to acquire Eris Digital Holdings. ErisX operates a U.S. based digital asset spot market, a regulated futures exchange and a regulated clearing house and Cboe plans to operate the digital asset business as Cboe Digital.

Ed Tilly, chairman, president and chief executive of Cboe Global Markets, said on the third quarter results call: “As the appetite for ownership in digital assets continues to grow, we believe Cboe can play a guiding role in shaping the trajectory of this revolutionary market. Today we are at a critical inflection point.”

Exchanges

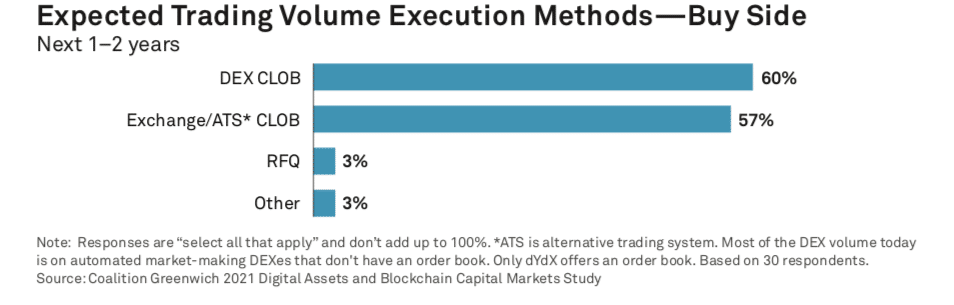

The Greenwich study said liquidity-seeking is evolving in digital asset markets from request-for-quote to streaming prices and order books. As a result, fully decentralized exchanges have emerged to offer new models and competition to exchanges, broker-dealers and alternative trading systems.

The consultancy expects central limit order books and derivatives on licensed exchanges to attract attention and interest in the next year.

Nearly half, 44% of front-office and the majority, 59%, of buy-side-only professionals in the survey expect the majority of digital asset trading volume to occur on fully decentralized exchanges over the next two years.

“This greater standing of non-regulated venues among the buy side may simply reflect the reality of existing liquidity, even with new markets (such as ATSs like Prometheum’s Ember ATS and Symbridge) being launched,” added the report. “We observe that decentralized exchanges, such as Binance DEX or Uniswap, currently offer lower friction to onboard, a sometimes better UI/UX experience, and often a wider breadth of assets to trade, making them relatively attractive.”

David Easthope, senior analyst for Coalition Greenwich market structure & technology and author of the report, said in a statement that countless firms are moving in to fill the gaps for institutional trading of digital assets, including trading platforms, prime services, market making, surveillance, analytics, custody, and settlement.

“This next phase in the evolution of crypto market structure will be highly dependent on how market participants approach the breadth of digital assets, and how regulators balance investor protection and ensure market integrity, while also supporting technology innovation and the growth of deep and liquid markets,” added Easthope.

.