We’re not political strategists, so we’re not going to forecast the winner of the U.S. presidential election. But our analysis today looks at what typically happens to markets around elections, which is likely to be a useful backdrop to what markets will do regardless of who wins the vote.

Last election, sector dispersion increased after the election

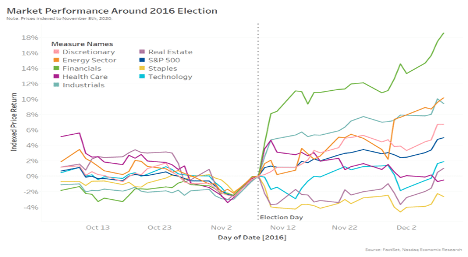

Sector returns around the 2016 election show that leading into the election, sectors became quite correlated, with relatively small over- or under-performance.

However, once the election results were known, sector performance varied significantly and almost immediately. Financials, industrials and health care rallied. Within a few days, the rally in health care had reversed course and was replaced by outperformance in energy and consumer discretionary stocks.

In hindsight, the market didn’t pick all the outperformers over the next four years, but they did position for some of the policies of the current administration.

This year, we’ve already seen a rally in ESG and green energy stocks, which would benefit from a Biden administration’s infrastructure plan.

Chart 1: Sector performance varied much more after the election

Whole volatility spikes ahead of elections

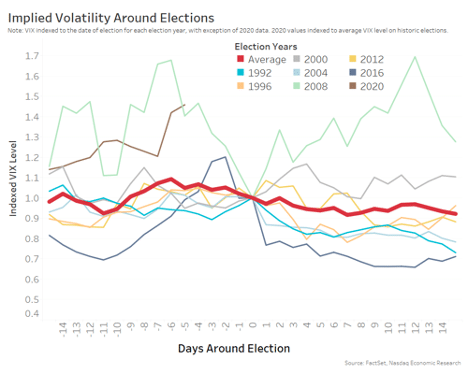

In contrast, expected volatility (priced into the VIX) tends to spike ahead of elections and relative calm returns shortly after the election is decided. Two clear recent exceptions were 2000 (the last time we had a contested election) and 2008 (in the middle of the worst of the credit crisis).

So far this year is no different, although the VIX is likely elevated due to Covid risks too.

Interestingly, the term structure of VIX futures shows elevated volatility is expected to last more than four months. That indicates the market expects another contested election, like 2000 when volatility remained elevated, regardless of the result. So the typical confidence boost that an election result provides is not expected this election.

Chart 2: Volatility typically spikes ahead of the election

Volumes usually elevated both sides on Election Day

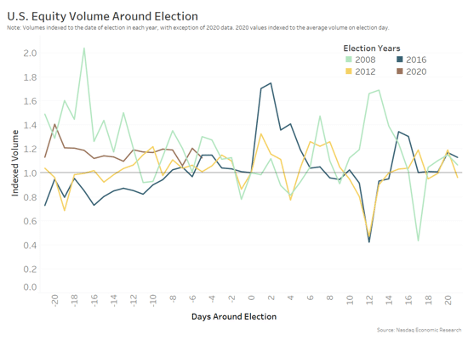

Trading activity tends to rise both sides of an election, although the level of activity is usually not that different to normal, with most days within 30% of normal. However, the unexpected election result in 2016 is an exception, with an 80% spike in volumes right after Election Day.

That makes sense given what we see in Chart 1. With sector outperformance starting quickly after the result is known, those positioning for the election result need to trade before the election – then price discovery and repositioning occurs after the election.

Chart 3: Volumes around elections.

Volume data from the 2000 election is much harder to get and to compare. Not only is it pre-Reg NMS, but automation of trading was just beginning and volumes were around 10% of current levels.

Returns usually stall before the election and recover after

Overall market performance also tends to stall leading into an election. Although once a result is known, the market tends to see a return to positive performance regardless of which party wins, even if the incumbent party doesn’t retain the White House.

Having said that, the year-by-year index performances are vastly different and few years are even close to the “average”. It’s also fair to say the worst reactions had little to do with the election: 2000 was the middle of the tech bubble bursting and 2008 was the middle of the credit crisis.

Chart 4: Returns around elections.

What does this all mean?

The market typically likes the certainty of an election, but picking stocks that benefit from the new administration needs to be done before Election Day.

However options markets suggest this year could be different, with a high likelihood that uncertainty persists for weeks or even months in the case of a contested result.

Given that, a clear result on November 4 might actually lead to more conviction and trading than normal. Unfortunately, it won’t remove any of the underlying risks and uncertainty that Covid-19 is also contributing to markets.

Election 2020: What to Expect from Markets was originally published by Nasdaq.