This is sponsored content from Enfusion

Simplicity. Efficiency. Transparency.

That’s what hedge funds want in a nutshell. Given their higher-risk strategies and risk they incur, these funds want to minimize all their other concerns, such as technology, back and middle office operations and data management. So, where can they find all this on a cloud-based system that features the latest technology all under one roof?

Enfusion.

Enfusion started out as a technical consulting company going back to the late 90s, President Jason Morris, told Traders Magazine. The original founders – all developers by background – would work with firms in the financial services industry to help them achieve the requirements that the systems out of the box couldn’t facilitate. Thus, after spending years working with systems that were heavy installs, clunky, and/or incredibly difficult to work with, Enfusion’s founders decided to write something better.

“The thesis for Enfusion was essentially to build the comprehensive SaaS offering that the asset management community craved, that was also nimble enough to cater to each manager’s unique needs,” Morris said.

Enfusion breaks technology barriers and removes information boundaries, creating enterprise-wide cultures of transparency and shared insight. The multi-tenant cloud solution is known to boost agility and efficiency, rationalize costs, and regulate resources. The journey started when developers Tarek Hammoud, Stephen Malherbe and Scott Werner met working at large hedge funds. They vowed to simplify financial technology infrastructure. In 2006, they conceived Enfusion as a Portfolio Management System, later adding a dual sided General Ledger and an Execution and Order Management System. The system wasn’t seamless, it was seam-free, built on one golden dataset; a pioneering approach to uniting front-to-back office.The global firm has seen eight offices across four continents: Chicago, New York, London, Dublin, Hong Kong, Mumbai and São Paulo and Singapore. As the Visa advertisement goes, Enfusion is “everywhere you want to be” for its over 450 client firms in the global investment management sector.

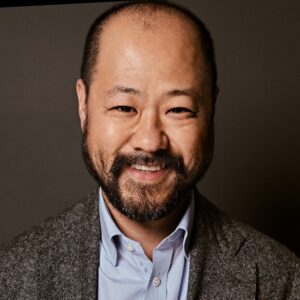

Recently, the firm brought on former Tassat executive Thomas Kim as its new Chief Executive Officer. Kim replaces Tarek Hammoud, the company’s previous CEO and an original founder. Hammoud will continue to serve as Executive Chairman to refocus on developing and innovating Enfusion’s software technology solution.

Kim brings an extensive background of trading technology leadership at multiple major financial institutions and software providers to Enfusion. He joins the firm from his previous role as CEO of Tassat, a rapidly growing FinTech firm based in New York. Prior to Tassat, Kim was Chief Operating Officer of the Investment Engine Group at the world’s largest hedge fund, Bridgewater Associates. Kim also held leadership roles at UNX, Lehman Brothers and TradingScreen among others. At Enfusion, Kim will advance the company’s global strategy and take over its existing business development initiatives.

“It’s an honor to become the CEO of this amazing company and join a global team that is dedicated to serving investment managers as a partner to help them achieve their goals,” Kim said. “With its recent product expansion, including the development of a managed services and data analytics offering, Enfusion has established itself as a leader in the investment management technology space. Enfusion’s success at simplifying the complex asset management industry through thoughtful innovation and a cutting-edge technology solution proves there is no limit on the impact that it can have within the capital markets space.”

With Kim in place and ready to go, the firm is ready to dominate business globally, despite its hedge fund leanings. The top 15 hedge fund managers collectively earned $12 billion in 2019, with the top five taking in more than $1 billion each, according to Bloomberg estimates. Yet last year the hedge fund industry generally underperformed the soaring US stock market last year overall, despite 14 of the top 15 funds posted double-digit returns.

“Enfusion always aimed to serve asset managers across the board, but hedge funds quickly became an area of momentum for us. They are often the earliest adopters of new technology within the community,” Morris explained. “Hedge funds intrinsically are looking for any edge they can get and market leading technology is right at the top of that list. Enfusion prides itself on being the fastest in the industry at taking a PM’s new investment idea and facilitating it into orders executed in the market. Hedge funds continue to recognize this compelling value proposition and this momentum has carried over into larger institutional asset managers as well.”

To that end, Enfusion partners with over 450 clients firms to transform their investment operational efficiencies by uniting software, services and analytics on one platform with one golden dataset. Built with a vision, the native multi-tenant cloud-based solutions covers workflows across trading, compliance, positions, accounting and strategic analytics to deliver consistent control for global financial management. Team members are enabled to leverage the same insight in real-time across the entire portfolio. With 8 global offices spanning 4 continents, Enfusion expert services team enables investment firms to communicate, analyze, scale and prosper, breaking information boundaries and catalyzing growth. With 99.8% customer satisfaction rate – that’s the difference between effective and efficient.

Among the company’s premier offerings are:

Pre/Post Trade Compliance

Real-Time Portfolio Monitors

General Ledger Accounting

Pre-Populated Security Master

Automated Trade Workflows

Another marquee software solution the firm offers is Enfusion Visual Analytics – EVA. EVA helps streamline hedge funds’ reporting and analysis in a fully-integrated solution, helping collate and organize deliverable emails that can point out actionable alpha hedge funds can incorporate into their trading strategies. The historically manual and time consuming data management process is dramatically shortened.

“Much like all of Enfusion’s solutions, Enfusion Visual Analytics (EVA) was developed directly with client input,” Morris explained. “We leveraged readily available technology for data visualizations and storage, and then worked with both hedge funds and institutional asset managers to build out the analytics capabilities our clients desired. We’re about two years since the initial idea of bringing EVA to life and are super excited to continue partnering with clients to evolve EVA’s capabilities.”

Ali Stewart, SVP, Global Head of Product Strategy at Enfusion added that EVA was born out of the need for our clients to do more with the powerful data from Enfusion. EVA allows clients to transform the data from Enfusion’s flagship product into analytics, time series analysis, chart and pixel perfect, branded reports.

“We saw clients struggling to take their data into third party applications, issues reconciling, historical back loads, and the cost of maintaining that data themselves,” Stewart explained. “We worked closely with clients in the early days to develop and in early 2019 hired a Product Owner with 15 years experience in portfolio analytics and reporting, Keeping with Enfusion’s innovative culture, we continue to collaborate with clients to deliver and industry leading product and have seen significant growth in the past 8 months.”