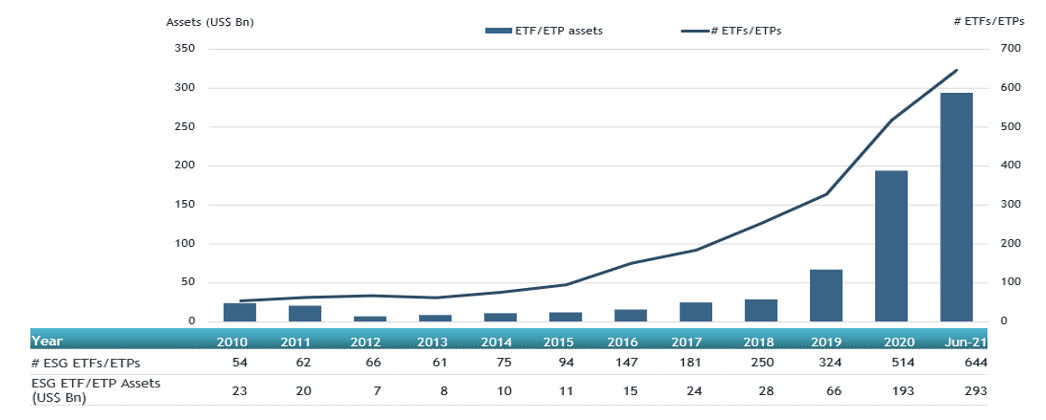

ETFGI reports record assets and net inflows in ESG ETFs world-wide of US$293 billion and US$83 billion respectively at the end of H1 2021

29 July 2021

LONDON — July 29, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today record assets and net inflows in ESG (Environmental, Social, and Governance) ETFs and ETPs listed globally of US$293 billion and US$83 billion respectively at the end of H1 2021. ESG ETFs gathered net inflows of US$9.09 billion during June, bringing year-to-date net inflows to a record US$83.04 billion which is much higher than the US$29.49 billion gathered at this point last year. Total assets invested in ESG ETFs and ETPs increased by 4.6% from US$280 billion at the end of May 2021 to US$293 billion, according to ETFGI’s June 2021 ETF and ETP ESG industry landscape insights report, is a monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Record $293 Bn invested in global ESG ETFs and ETPs industry at end of H1 2021.

- Assets have increased 51.6% in H1 going from $193 Bn at end of 2020 to $293 Bn at end of H1 2021.

- Record H1 net inflows of $83.04 Bn beating prior record of $29.49 Bn gathered in H1 2020.

- $83.04 Bn H1 net inflows are just $5.91 Bn below full year 2020 record net inflows $88.95 Bn.

- $199.35 Bn in net inflows gathered in the past 12 months.

- 64th month of consecutive net inflows

- Equity ETFs and ETPs listed in Europe gathered a record $59.61 Bn in net inflows in H1 2021.

“The S&P 500 gained 2.33% in June and are up 15.25% in the first half of 2021. Developed markets ex-U.S. lost 0.82% in June but are up 9.96% in the first half. Emerging markets are up 0.47% in June and are up 9.03% in the first half.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

The Global ESG ETF/ETP had 644 ETFs/ETPs, with 1,899 listings, assets of US$293 Bn, from 145 providers on 37 exchanges in 30 countries. Following net inflows of $9.09 Bn and market moves during the month, assets invested in ESG ETFs/ETPs listed globally increased by 4.6% from $280 Bn at the end of May 2021 to $293 Bn at the end of June 2021.

Global ESG ETF and ETP asset growth as at end of June 2021

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products have increased steadily, with 644 ESG ETFs/ETPs and 1,899 listings globally at the end of June 2021.

During June, 23 new ESG ETFs/ETPs were launched.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $4.90 Bn in June. iShares Trust iShares ESG Aware MSCI USA ETF (ESGU US) gathered $616 Mn the largest net inflows.

Top 20 ESG ETFs/ETPs by net new assets June 2021

| Name | Ticker | Assets(US$ Mn)Jun-21 | NNA(US$ Mn)YTD-21 | NNA(US$ Mn)Jun-21 |

| iShares Trust iShares ESG Aware MSCI USA ETF | ESGU US | 18,417.78 | 2,900.00 | 616.44 |

| iShares Trust iShares ESG Aware MSCI USA ETF | BEGU39 BZ | 684.41 | 545.25 | 545.25 |

| Quadratic Interest Rate Volatility and Inflation ETF | IVOL US | 3,501.87 | 2,620.30 | 377.53 |

| iShares ESG MSCI EM ETF | ESGE US | 7,991.97 | 1,384.70 | 373.97 |

| iShares ESG MSCI EAFE ETF | ESGD US | 5,959.65 | 1,635.37 | 282.60 |

| iShares MSCI USA ESG Screened UCITS ETF – Acc – Acc | SASU LN | 3,631.35 | 1,296.76 | 227.94 |

| Xtrackers MSCI USA ESG UCITS ETF – 1C – Acc | XZMU GY | 2,887.86 | 944.71 | 218.38 |

| iShares Euro Corp Bond SRI UCITS ETF | SUOE LN | 2,566.06 | 353.16 | 218.20 |

| Invesco Solar ETF | TAN US | 3,568.17 | 579.26 | 217.76 |

| Ossiam Euro Government Bonds 3-5y Carbon Reduction UCITS ETF – Acc | OG35 GY | 489.67 | 214.91 | 209.98 |

| iShares Global Clean Energy UCITS ETF | INRG LN | 5,753.83 | 1,597.83 | 208.98 |

| UBS Lux Fund Solutions – MSCI Japan Socially Responsible UCITS ETF (Hedged to USD) | JPSRU SW | 209.85 | 206.30 | 203.15 |

| Vanguard ESG US Stock ETF | ESGV US | 4,801.79 | 1,314.75 | 196.76 |

| iShares MSCI EM SRI UCITS ETF – Acc | SUES LN | 2,355.63 | 510.06 | 150.47 |

| Xtrackers MSCI World ESG UCITS ETF – 1C – Acc | XZW0 LN | 2,489.21 | 970.98 | 148.87 |

| AMUNDI INDEX MSCI USA SRI – UCITS ETF DR (C) – Acc | USRI FP | 3,760.63 | 1,563.48 | 148.78 |

| iShares MSCI Europe SRI UCITS ETF – Dist | ISED NA | 724.60 | 249.41 | 141.87 |

| UBS Lux Fund Solutions – MSCI Japan Socially Responsible UCITS ETF (Hedged to EUR) | JPSRE SW | 233.13 | 155.15 | 141.32 |

| iShares ESG MSCI Mexico ETF | ESGMEX MM | 1,380.64 | 431.53 | 136.05 |

| UBS Lux Fund Solutions – MSCI Japan Socially Responsible UCITS ETF (Hedged to CHF) A-dis | JPSRT SW | 153.56 | 141.16 | 132.26 |

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity.