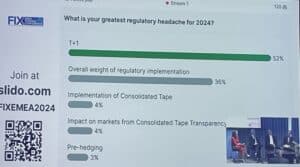

The implementation of faster settlement times in the US is their biggest regulatory headache this year according to participants at the FIX EMEA conference.

The majority, 52%, of attendees who took part in a poll at the conference in London on 7 March said they were most concerned about T+1.

The standard settlement cycle for most US broker-dealer transactions in securities will be reduced from two business days after a trade, T+2, to T+1 on Tuesday 28 May 2024. Canada and Mexico are moving on the previous day, the U.S. Memorial Day holiday. In addition to affecting settlements, the move to T+1 will also impact how firms will approach foreign exchange execution and settlement due to the amount of overseas investment in US securities.

One panellist said they had put people in New York in order to meet the shorter settlement period but this is not an option for smaller fund managers. Due to the time zone differences, overseas investors may need to pre-fund transactions in order to meet the US deadlines or use an overdraft facility from a custodian, which both make trading more expensive and will add cost for the end investor. Fund managers may also stop using brokers who have inefficient settlement processes and cannot meet the shorter timescale.

Concern was also expressed that a potential increase in trade failures could lead to systematic risks if there is an increased demand for securities lending which cannot be met. However, another poll at the conference found that the majority, 72%, felt they are on track to meet the May deadline for T+1.

Due to the size of the US market, other jurisdictions will follow in cutting their settlement cycles.

In October last year ESMA, the European Union’s financial markets regulator, launched a consultation on shortening the settlement cycle across its 27 member states. The European Commission held a roundtable on the topic in January this year and Commissioner McGuinness said the key question “is not if Europe will make the move to T+1 settlement. Instead, the key issue is when and how we move.”

The UK has set up an accelerated settlement taskforce and the consensus is that the move to T+1 will take place, and the discussions are around how to facilitate this transition. A technical group was launched in January this year, with more than 200 volunteers from more than 60 organisations, to discuss the work that needs to be done, especially around foreign exchange and stock loan recalls. In 2025 the taskforce aims to release a timeframe of preparation needed to move to T+1.

India moved to T+1 last year and Argentina and Brazil have also said they intend to make the move. In Asia Pacific, Taiwan and South Korea are also considering T+1.

FIX’s 30-year anniversary

FIX made the first public release of its messaging protocol in July 1994, which has coincided with the growth of electronic trading by enabling connectivity across market participants. Since launch FIX has added five messages each year, on average, and 11 updates have been made since last year’s EMEA conference.

Focuses for this year include increasing interoperability for digital assets, both between chains and with traditional finance and developing protocols for securities lending, where processes are still very manual,