The US cut its securities settlement cycle in May this year and the mismatch with Europe has led to lower trading volumes of exchange-traded funds on a Thursday due to the increase in funding costs.

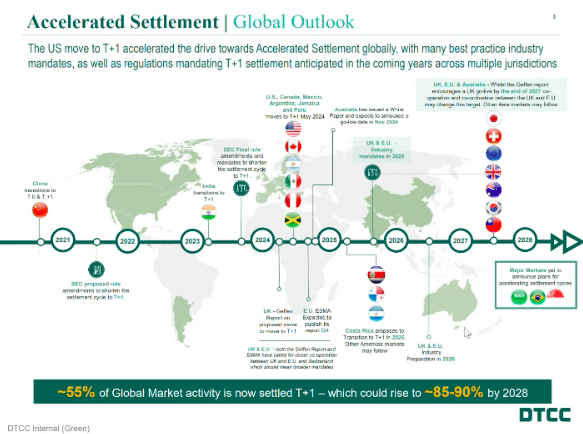

On 28 May this year the US, Canada, Mexico, Argentina, and Jamaica shortened their settlement cycle for equities, corporate bonds and municipal securities to one day after the transaction date (T+1) from T+2. As a result other jurisdictions, including the UK and the EU, are also reviewing shortening their settlement cycles to align with the US market. In Asia the Australian exchange is consulting on T+1 and Japan, Singapore and Taiwan are also looking to move.

European Securities and Markets Authority (ESMA), the European Union financial regulator, held a public online hearing on shortening the settlement cycle in the trading bloc on 10 July 2024, which was watched by more than 500 participants.

Val Wotton, general manager of DTCC’s institutional trade processing, said at the hearing: “The expectation is that by 2028, close to 90% of global markets will be operating in a T+1 environment.”

The US shift to T+1 has presented challenges to fund managers in Europe and Asia who have to meet shorter settlement cycles for their US investments, while their own markets still settle on a T+2 basis. In particular, there are increased operational challenges for authorized participants and market makers of ETFs which invest in baskets of equities including US securities.

Jim Goldie, head of ETF capital markets and indexed solutions, EMEA, at asset manager Invesco, said at the hearing that the level of preparedness for the US migration to T+1 was very high. In order to accommodate the move to T+1 Invesco allowed a window after market close on the day before a trade for creating redemptions for primary market trades on the following day.

Goldie said: “There’s been a lot more operational complexity. However, we haven’t had any breaches as a result of the move to T+1 or issues with FX, corporate actions or securities lending because the industry adapted very well.”

However, Goldie added that the misalignment of settlement cycles has led to a funding gap which manifests itself through higher spreads of a basis point or more.

“The other dynamic we need to consider is the Thursday dynamic where it is more expensive to create US ETFs on that day and hedge the underlying basket which settles T+1 on a Friday,” he added. “Funding is required over the weekend when overnight interest rates in the US are over 5%.”

Adding three days of funding to an ETF trade can cost investors an additional four or five basis points, according to Goldie.

Invesco’s volumes as an ETF market maker have increased by around 40% in the six weeks since the transition to T+1, but volumes on Thursday have only risen 5%.

“If you look at the whole industry’s secondary market volumes for ETFs that track US or global securities, volumes up 18% on a Wednesday, up 24% on a Friday, but down 13% on a Thursday,” said Goldie.

He argued that if Europe also aligned to T+1, then these funding issues would disappear.

“We have created a dynamic where it’s more expensive to trade depending on the day of the week,” he added. “We also see a dynamic where brokers will show one price to a client trading T+1, and a more expensive price to a client that has to trade on a T+2 basis.”

Foreign exchange

Before the T+1 migration, concerns had also been expressed about overseas managers needing to complete their FX trades for US transactions in time to meet the cut-off requirements when using CLS (Continuous Linked Settlement). The FX settlement infrastructure was set up to reduce settlement and counterparty risk, and currently operates across 18 eligible currencies. CLSSettlement offers FX settlement risk mitigation through payment-versus-payment settlement and liquidity optimization through multilateral netting.

Marc Bayle de Jessé, chief executive of CLS, said at the hearing that the infrastructure carried out an analysis of the impact of T+1. The review found that a very minimal amount of the volume that CLS settles every day, $6.6 trillion, would be affected.

“In this context, we took the decision to not change the cut-off time of midnight CET for the stability of FX settlement processes,” he said.

In fact, after the migration CLS had record volumes in June of an average $7.8 trillion every day. De Jessé highlighted that alongside the increase in volumes, CLS has seen some changes in trading patterns, with more volumes earlier in the day.

“There is a peak between 10 CET and 11 CET where we see extra activity that previously came after midnight,” he added. “A change of behavior has allowed us to bring in those trades earlier.”

CLS will continue monitoring activity over the summer and issue another statement in September.

US experience

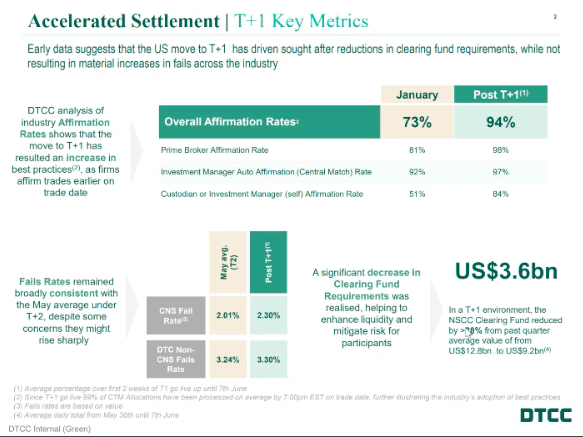

Wotton described the US experience of moving to T+1 as very successful, especially as there have not been any issues on subsequent high volume days in the US equities market which have included an MSCI rebalancing, triple witching and the annual Russell rebalancing.

For the move to T+1, the US Securities and Exchange Commission mandated a 9pm CET cut-off time for affirmations with the DTCC, the central US post-trade infrastructure, and a best practice that all allocations should be completed by 7pm.

“The most striking number is that the affirmation rate is up to 94%, which is 4% better than in a T+2 world and it continues to trend that way. The only issue for a transaction to fail is due to lack of inventory,” said Wotton.

Overall fail rates in the US are also very much in line with the T+2 world according to Wotton. Shorter settlement has also reduced DTCC’s clearing fund by 28%, and DTCC has returned $3.6bn which market participants can allocate to other activities.

“The regulatory mandate is critical as it provides certainty and is critical to getting investment for post-trade,” said Wotton. “Post-trade processes have faced significant under-investment, so this is a catalyst to drive automation and straight-through processing.”

Timeline

Participants in the hearing stressed the importance of setting a date for the move to T+1. A poll amongst the online audience found that the majority, nearly three quarters, said the EU should move to T+1 by the fourth quarter of 2027:

Participants also stressed the importance of the EU migration being coordinated with the UK and Switzerland, and 2027 would potentially meet this requirement.

The UK government set up the Accelerated Settlement Taskforce to explore the potential for faster settlement of securities trades in the UK. In March this year the taskforce published its report which recommended moving to T+1 settlement for all securities trading on UK trading venues. The UK government accepted all the recommendations and endorsed the timeline of “no later than the end of 2027”.

Gary Gensler, chair of the US Securities and Exchange Commission, spoke to a conference on Accelerated Settlement in the UK in London in June and highlighted the importance of setting a date for the transition, which does not change, as well as having a well-thought-out timeline and schedule.

In the US the time between the SEC proposing the T+1 rule in February 2022 to implementation was 27 months, and 15 months from final adoption to implementation. Gensler said there is a public good in regulators setting a mandate as it allows market participants to coalesce and organise.

Rodrigo Buenaventura, chair of Spanish regulator CNMV and chair of ESMA’s markets standing committee, concluded the hearing by saying there is a consensus that the complexity of post-trade is way higher in the EU than in other jurisdictions that have tackled T+1.

“The clear conclusion is that nobody thinks we can stay as we are forever and overall, the position is that the fourth quarter of 2027 seems feasible provided that clarity and certainty come soon,” Buenaventura added. “No major roadblocks have been identified so far and I think it’s clear that we need that strong governance and coordination to be established sooner, rather than later, to make this possible.”

In addition, Buenaventura stressed there is a strong case for alignment with the UK migrating to T+1, and eventually with Switzerland.

Verena Ross, chair of ESMA, said at the hearing that the regulator is required to publish its report on the Central Securities Depositories Regulation (CSDR) regulation by the middle of January next year. CSDR aims to harmonize certain aspects of the settlement cycle and provide a set of common requirements for CSDs operating across the EU and the regulation will need to be amended for T+1.