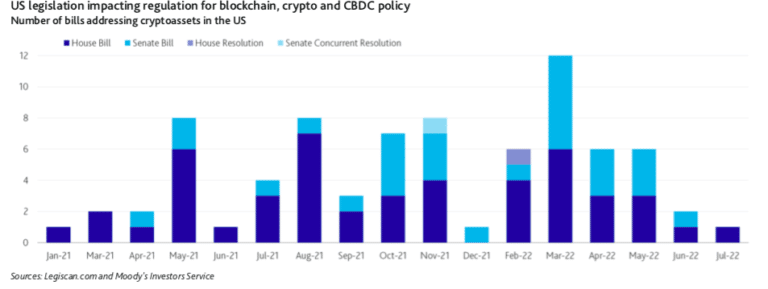

More than 150 pieces of legislation related to blockchain, decentralized finance, cryptocurrencies, digital or virtual currencies, and other digital assets have been introduced since the start of the most recent Congress, which would need to be more aligned if they pass, according to Moody’s Investors Service.

The ratings agency said in a report that a clear regulatory and supervisory framework with the potential to prevent fraudulent activity and provide clear guidance to allow companies to innovate would be credit positive because it would protect consumers and ensure that the industry does not become a source of financial instability, while allowing for any potential benefits from the crypto industry to be realized.

“Moreover, regulations would likely root out any inefficiencies in the crypto sector, which would become apparent once the regulations are in place – particularly given that crypto assets currently compete with regulated entities and products, meaning that their efficiencies or competitive advantages could ultimately stem from advantages that are only present in the absence of regulatory oversight,” added Moody’s.

The latest proposal was released on August 3 when a bipartisan group of senators including Senate Agriculture Committee Chair Debbie Stabenow proposed giving the Commodity Futures Trading Commission new tools and authorities to regulate digital commodities.

They introduced the Digital Commodities Consumer Protection Act of 2022, which follows on from Senators Kirsten Gillibrand (D-NY), member of the Senate Agriculture Committee, and Cynthia Lummis (R-WY), member of the Senate Banking Committee, introducing the Responsible Financial Innovation Act in June which also assigns regulatory authority over digital asset spot markets to the CFTC.

Moody’s said the bills are unlikely to be adopted this year but are likely to kick off a protracted congressional debate that lasts well into next year.

“If the bills gains traction, either in their current form or, more likely, in a modified or fragmented version, the general public and traditional financial institutions would be more likely to move toward broader adoption of crypto assets,” added the ratings agency.

In addition, Moody’s said the US House of Representatives’ debate on the legislation that would restrict stablecoin issuers to banks and other designated financial institutions that submit to federal scrutiny has been formally postponed until September.

International coordination

The ratings agency continued that globally regulators have a challenging task of managing crypto asset risks without stifling innovation so it will be important to achieve international consistency in regulatory and supervisory approaches, such as in the legal validity of smart contracts.

“Significant gaps between the different approaches might lead to regulatory arbitrage and a subsequent migration of resources, both human and financial, to the countries with the most accommodating laws,” said Moody’s.

In July the US Treasury published a framework on how the US should engage with international counterparts on digital assets and help form international standards through bilateral and regional initiatives to limit overlap and enhance coordination.

“The course that the crypto asset class takes in the coming years will be significantly influenced by the speed, degree of harmonization and prudentialism that regulators adopt,” added Moody’s. “While putting an emphasis on prudential, ethical and sustainability considerations, regulators will likely continue to work on creating a framework that will allow the benefits of crypto assets to be realized, without jeopardizing financial stability.”